Journey from compliance to business

Journey from compliance to business

In the era of rapid digital transformation, the financial industry has witnessed a paradigm shift with the advent of Open Banking. Originally conceived as a regulatory requirement, Open Banking has transcended its origins to become a catalyst for innovative business strategies in the financial environment. This evolution from simple compliance to a proactive engine for business growth is a major milestone in the financial sector.

Open Banking: Transitioning from Compliance to Business Growth

Open Banking, a regulatory framework that promotes the sharing of financial information securely between financial institutions and third-party providers (TPPs), is transforming the landscape of the banking industry. As top managers navigating this shift, understanding the critical considerations for implementing Open Banking at both country and bank levels is paramount.

Country and Bank-Level Implementation

At the country level, a clear and defined framework is necessary. The Technical Service Provider (TPP) onboarding process, regulated by the National Competent Authority (NCA), requires meticulous attention. This involves registration, passportization, and the issuance of technical certificates (eIDAS) to ensure secure TPP authentication by banks.

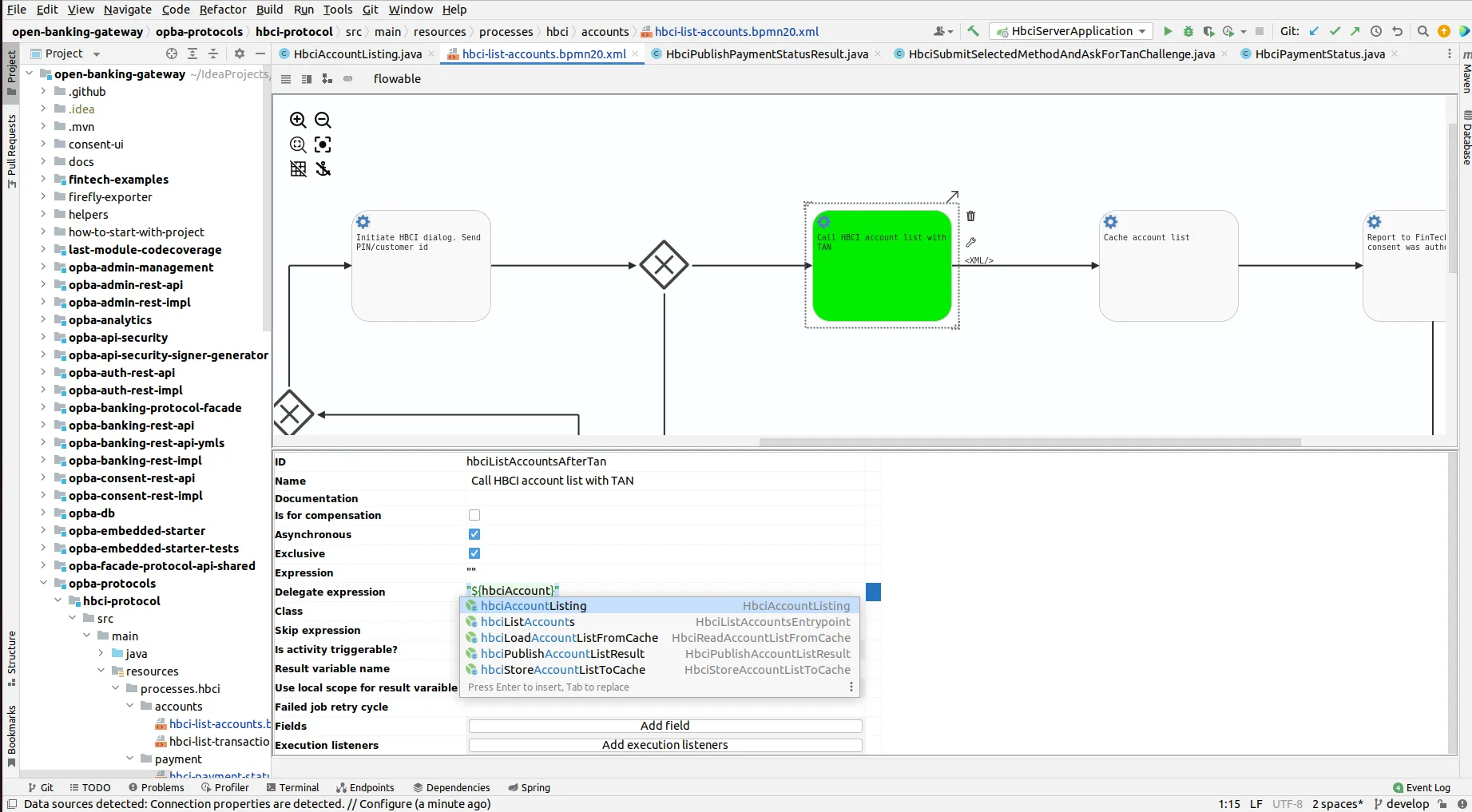

From the banks' side (Account Servicing Payment Service Providers - ASPSPs), onboarding TPPs involves authorizing the initial Payment Initiation Service (PIS) or Account Information Service (AIS) request. Additionally, providing robust API Documentation & Sandbox environments for TPPs to test connections with bank APIs is vital. A well-maintained sandbox replicating the production environment streamlines integration.

Mandatory Services and Technical Requirements

The legislation should define mandatory services, but their implementation may vary among banks based on product catalogs and capabilities. Non-discrimination is crucial; PSPs must receive services similar to those offered to bank clients (Payment Service Users - PSU).

Technical aspects demand clear security protocols, authorization, and data storage definitions set by the NCA. Internal consent management systems on the bank side should automate processes aligned with local laws.

Fraud, Incident Management, and Reporting

The NCA should outline APIs for Fraud and Incident reporting, with Non-functional requirements specified for API accessibility and Performance Reporting.

Best Practices and Implementation Models

Various implementation models exist, each with its merits. Individual solutions offer control but can be costlier and slower to update. Shared SaaS solutions decrease costs but might lack direct API monitoring. Centralized solutions streamline implementation but may require customization costs.

Irrespective of the model chosen, certain prerequisites are fundamental. Effective API management, notably through Developer Portals & Sandboxes, significantly influences success. These portals facilitate TPP onboarding, serve as API guides, foster collaboration, and aid innovation.

API Competency and Future Outlook

Open Banking is just the initial stride towards Open Finance and Open Data. Institutions must evolve into API organizations, treating APIs as products. Banks must enhance API competencies, aligning them with business strategies and key performance indicators (KPIs).

In conclusion, learning from best practices, aligning implementation models with business strategies, creating checklists, leveraging compliance for growth, and seizing opportunities within Open Banking are pivotal for banks to thrive in this evolving ecosystem.

Open Banking is not merely about compliance; it's a strategic gateway to embrace innovation, foster collaboration, and drive business growth in the dynamic financial landscape.

For more details watch the video (in Ukrainian) at the conference “Global Payments Day 2023” (link is on top).

If you want to talk or get a consultation about Open Banking, feel free to contact us.

Similar posts

Talk to our experts!

Sent successfully

Your message was successfully sent.

We will contact you as soon as possible