Exploring Strong Customer Authentication (SCA)

Exploring Strong Customer Authentication (SCA)

On the 7th of March, representatives of Ukrainian banks had the opportunity to gain valuable insights into PSD2 and Strong Customer Authentication (SCA) during a dynamic webinar hosted by Olga Levandovska and Valentyn Berezin from GD Next, a technology services company specialising in banking and finance with expertise in open finance, in partnership with experts from Wultra, a digital finance guarantor that provides banks and fintechs with easy-to-deploy modern authentication solutions, diving into the process of Strong Customer Authentication (SCA). Rich in insights and experience, this webinar shed light on the key aspects shaping the future of banking security and customer experience.

At the beginning of the webinar, Olga described the process of adapting the international standards of Strong Authentication (SCA) in Ukraine. As Ukraine moves towards Open banking, this initiative obliges banks to open their APIs to authorised third-party service providers, thereby allowing such providers to initiate payments and access customer account information with the customer's consent. Olga noted that, in turn, Strong User Authentication (SCA) is a key requirement of the PSD2 directive, which aims not only to strengthen the security of electronic payments and account access, but also to protect protocols on banks' internal channels, as well as at payment service providers (PSPs) and third-party providers (TPPs). According to PSD2, this is achieved through the implementation of multi-factor authentication, which requires at least two of three possible types of credentials.

Olga Levandovska highlighted the challenges associated with traditional SCA methods, particularly SMS OTP, elucidating the escalating security concerns stemming from phishing attacks, vulnerabilities in Android platforms, and SIM swapping attacks. Recognizing the imperative to evolve beyond SMS OTP, she noted the importance of implementing more secure authentication methods, such as mobile authentication, to mitigate risks effectively.

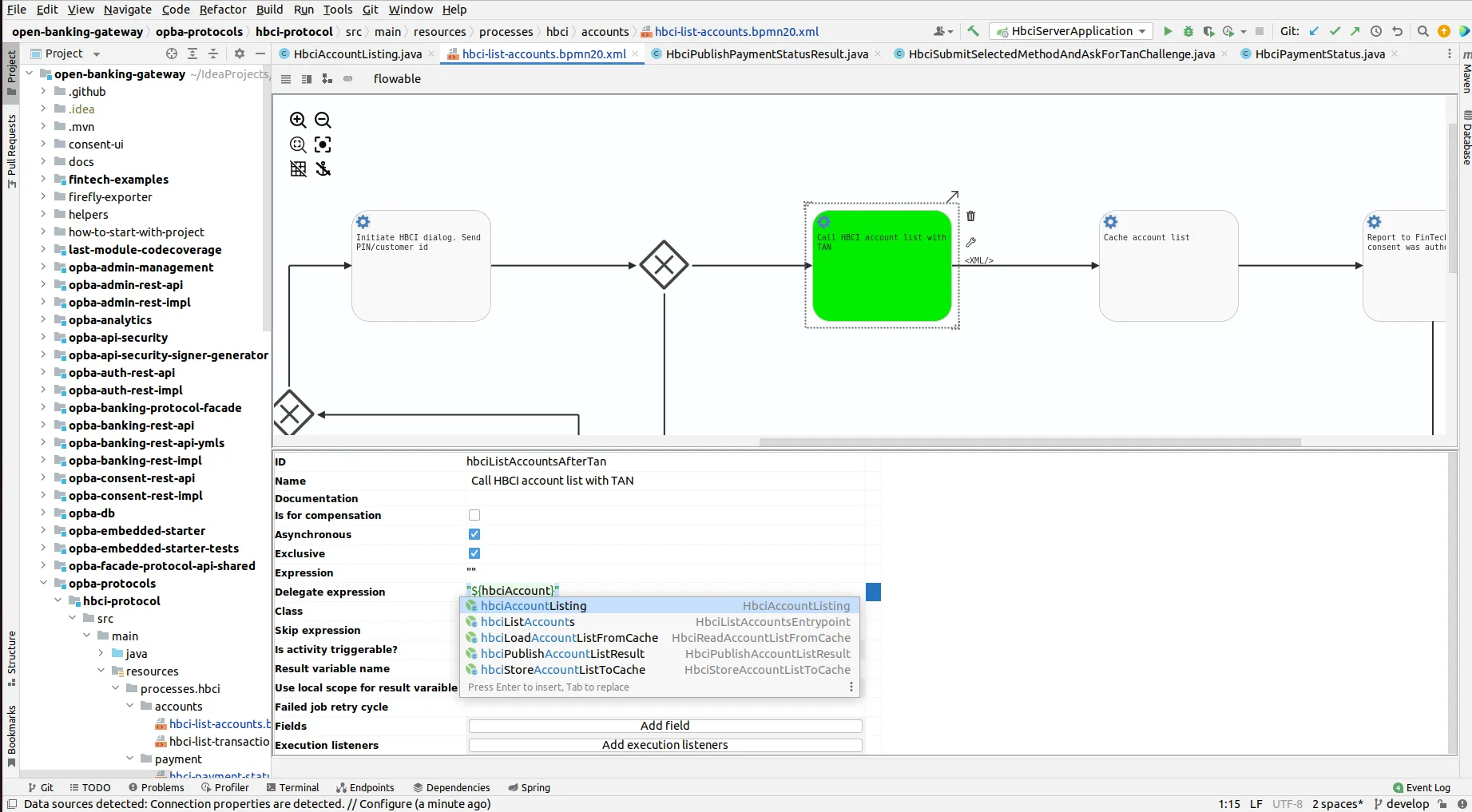

Continuing, Valentyn Berezin showcased the transformative benefits of Wultra's authentication solutions, elucidating how they address the critical need for secure data exchange between clients and banking infrastructure. Valentyn demonstrated how Wultra's solution can reduce the risks of identity compromise with the help of digital deepfakes today. He noted that, unlike Face ID, for example, Wultra's solution verifies the presence of a person near the device, not a video face, using additional checks. Valentyn also mentioned that due to the SDK for iOS and Android, this solution is very easy to integrate with existing applications or with new applications.

The webinar underscored the importance of embracing modern authentication solutions to navigate the evolving landscape of banking security and regulatory compliance. By prioritizing security and user experience, Ukrainian banks can foster trust and loyalty among customers while staying ahead of industry mandates.

In conclusion, the collaboration between GD Next and Wultra exemplifies a commitment to empower Ukrainian banks with cutting-edge solutions tailored to meet the demands of modern finance. Through continued innovation and partnership, Ukrainian banks are well-positioned to thrive in an increasingly digitalized financial ecosystem.

Similar posts

Talk to our experts!

Sent successfully

Your message was successfully sent.

We will contact you as soon as possible